It was a few years ago when Innocent Chizaram Ilo, an educated young man in the bustling state of Lagos, realized he was actually financially excluded from Nigeria’s banking and finance system. He had won an international writing award in the form of a monetary prize. In an attempt to access his funds, he was asked to upgrade his account. What seemed like a straightforward request turned into a grueling ordeal—15 visits to the bank, all under the sweltering Lagos heat and traffic. The process demanded everything from referees with both salaried and non-salaried bank accounts to utility bills and more. This story highlights the barriers that still hinder access to simple, human-centered, and innovative banking services.

If you dig deeper, very similar stories pour in, stories like that of Bimpe Akinremi, who spoke to the Premium Times, and many other women who make up the 25 million of Nigeria women who are unbanked. How?, you might ask, are women more unreached for banking and finance products than men? For Bimpe, living in Apatere, a town in southern Nigeria, many of their men have jobs that take them out of town to places where financial touchpoints exists, however for many of the women, who are uneducated and have localized businesses, they don’t have access to any services in the rural areas where their businesses are set up. This is a huge untapped opportunity. Further statistics have shown that young enterprising adults now have access to both smartphones and the applications in them, active on X, Facebook and WhatsApp; these demographics have shown great interest in technological services, with eagerness to learn.

All these are just a few reels of what robust opportunities exist for FinTechs in Nigeria’s over 200,000,000 population.

Nigeria has made some huge leaps in several industries in recent years, but arguably none more significant than in FinTech, yet about 40% of the adult population remains either unbanked or underbanked.

The need for innovation in product, customer experience, brand, networks, channels and profit models is paramount, and the opportunities are boundless.

In a recent study our team undertook, we uncovered interesting data and opportunity areas, here are some of them:

- Untapped regions and demographics: As with the stories above, untapped locales and demographics exist within the country. Currently, teenagers and young adults make up over 70% of Nigeria’s population, with 63% under the age of 25. By 2030, research suggests this number could exceed 165 million. This means young people will increasingly shape the country’s economic future through purchasing decisions, human capital, and entrepreneurship. With nearly 60% of 14-18 year-olds having access to smartphones and tending towards new technologies, there’s a huge potential to develop solutions tailored to the unique lifestyle needs of the Nigerian and African youth. Even more competitive? Looking into the trends that determine the behaviour patterns of this generation and designing solutions for them. One of these patterns is the shift of talent to Africa, the youth are not unaware of this shift and the opportunities that lie within. Exploring areas such as this will not only move this hungry and enterprising demographic to the solution, but will also make any FinTech seize the opportunity to be competitive.

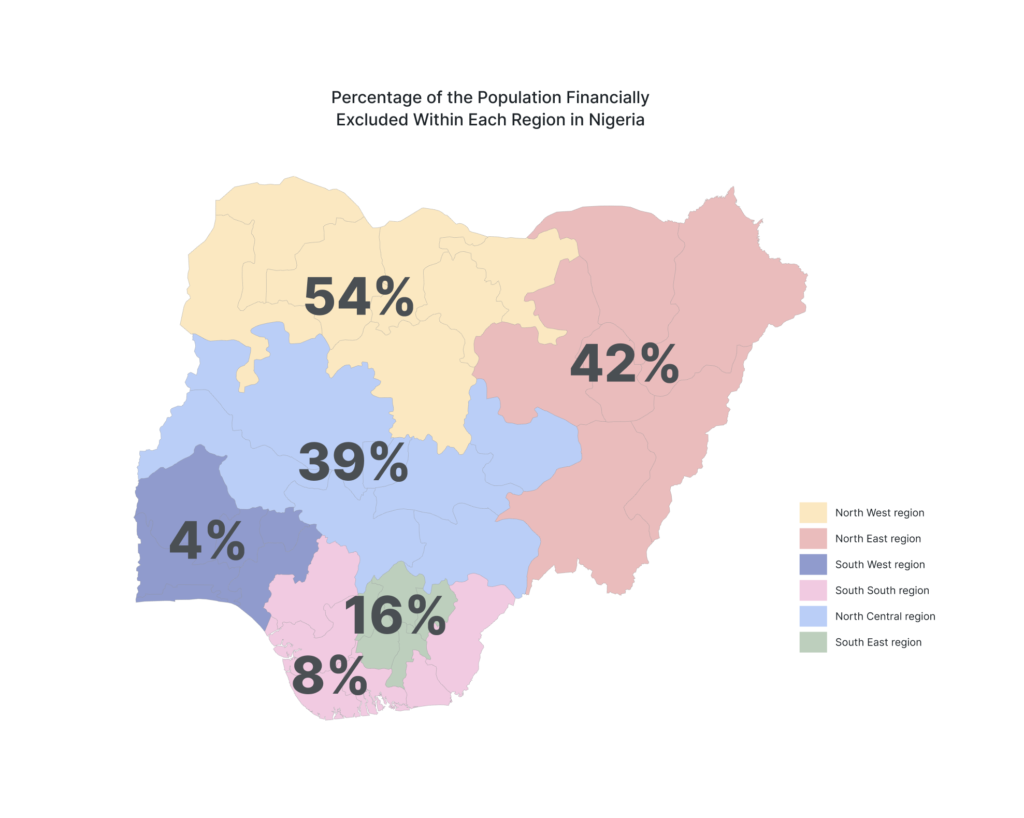

Northern Nigeria has another huge potential, being one of the largest financially excluded regions in the country, currently 54% and 42% of the populations in North-west and North-east Nigerian respectively are. While cultural and religious nuances in Northern Nigeria have posed challenges for some FinTechs, they also hold keys to tailored solutions and present blue ocean opportunities. Tapping into the needs of the specific people groups in these regions as well as their governments support could offer unique growth and market entry opportunities. For example, one of the first executive orders Kaduna State Governor, Senator Uba Sani, signed was that of financial inclusion; due to this push, over 2 million people have been ushered into financial services.

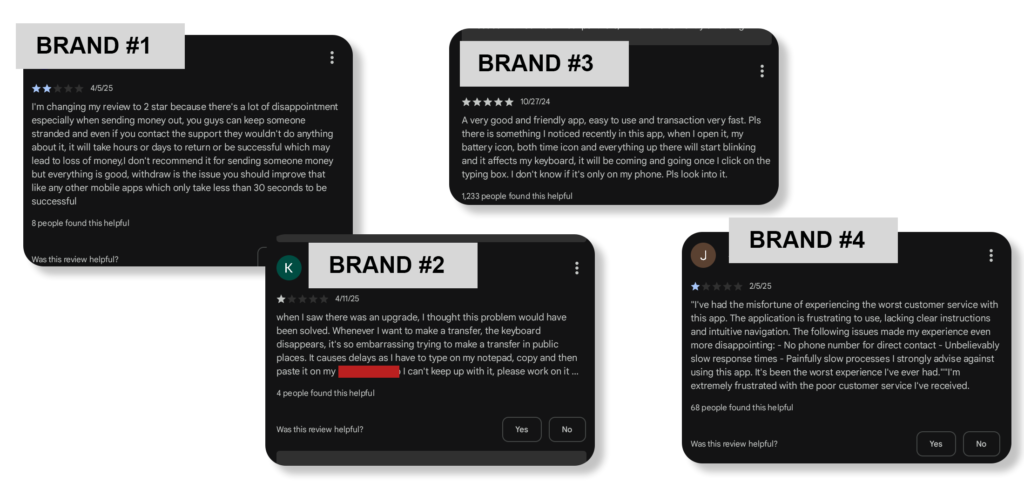

- Customer Experience (CX) and User Experience (UX): In recent times, there has been a shift in the design industry to merge the areas of Customer Experience (CX) and User Experience (UX), a move we personally believe has been long overdue.

To shed a little bit of light on these 2 areas: Customer Experience is more strategic in nature, focusing on the entire interaction customers have with an organization. User Experience, though originally meant to focus on the totality of the interactions that users have with an organization*, settled on becoming more tactical and centers more on the user’s interaction and experiences with digital products, often focusing on functionality, usability, and overall design of the solution. For decades, these 2 areas have been managed and dealt with separately, however, much value exists in bringing both areas within organizations to work together, ensuring that the micro-level user experience can easily access, understand and is guided by the more macro-level strategic vision of Customer Experience, deliver competitive, and high-quality services on all customer touchpoints.

Both disciplines are similar in that they place the users at the center of the process of solutioning. Thinking on the current landscape of customer service in Nigeria, companies that are able to utilize both strategically and effectively, or hire people who stand to gain competitively within Nigeria’s FinTech context. In this heavily customer-facing sector, this is a huge area of opportunity for FinTechs to command brand loyalty and market share in the areas of Customer experiences, both on digital and physical. With the affordances that emerging technologies allow, new experiences can be designed for highly competitive customer experiences, with minimal costs and high creativity.

*Nielsen Norman Group

- Charting New Territories: In the area of diversifying revenue models, there are exciting possibilities to innovate in a variety of areas, one of such is in the area of insurance, which has a penetration of about 1% or less in Nigeria. Regulatory hurdles and low consumer trust are no doubt challenges for finance houses, the rise of creative tech-enabled businesses that are emerging every day in this context opens up opportunity areas for FinTechs to innovate. By partnering with insurance providers, for instance, who have already navigated a lot of the regulatory ‘roadblocks’, this untapped area unlocks a world of possibilities for FinTechs through partnerships. Beyond this, the sheer lack of competition in this space embodies a blue ocean opportunity waiting to be seized.

The diverse needs of Nigeria’s population present so many opportunities for innovation. There are solutions yet unborn and markets yet to be explored. Our research uncovered even more untapped areas, making this an incredibly exciting time for both established and emerging FinTechs. But quite frankly, the question isn’t whether opportunity exists, it is who will move fast enough to seize them first?

As a wide area of opportunities are explored, the needs of different demographics are investigated, and new areas of revenue diversification are sought after, a key principle for FinTechs to remember and never lose sight of is delivering simple, smarter, tech-enabled and human-centered offerings that respond to the diverse areas of needs and lifestyles of different people groups.

Author

-

Susan Onigbinde has 12 years of experience working with and leading teams in design, research, and strategy, collaborating with global brands to create solutions that benefit communities.

View all posts